Top Features and Benefits of Personal Loan

Flexible Loan Amount

Choose any loan amount starting from Rs. 50,000 upto Rs. 25 lakhs.

24 Hour Disbursal

Your loan will be credited within a day after your loan application has been approved

Collateral Free Loans

You don’t have to arrange for any guarantor or pledge any asset while applying for personal loans from MoneyGray

Affordable Interest Rates

Avail loans at affordable rates starting at just 0.75% per month

Looking for the best personal loan in the market? MoneyGray personal loans come with a whole host of benefits. All you need to do is fulfill our eligibility criteria.

How is Personal Loan Eligibility Calculated?

Personal loan eligibility is calculated based on the borrower’s credit score, income, and age among other factors.

In order to get an instant personal loan from MoneyGray, the following eligibility criteria will have to be fulfilled -

Type of Employment

You must be Salaried or Self Employed (own business)

Monthly Income

Your monthly in-hand income should be Rs 13,500/- or more.

Income in Bank

Your salary must be directly credited to your bank account

Credit Score

You must either have a minimum CIBIL score of 600 or a minimum Experian score of 650. Low Credit Score? You may still get a loan based on our own credit-assessment model.

Age

Applicants must be between the ages of 18 years to 55 years

Do you fulfill the above criteria? Check your custom loan offer in 2 minutes by clicking here

Personal Loan Eligibility Criteria Based On The Applicant’s City Of Residence

| Income and Credit Score Eligibility Criteria | |||

|---|---|---|---|

| Salaried Individuals | Minimum In-Hand Income | Area of Residence | CIBIL Credit Score Requirement |

| Rs 13,500 | Any | CIBIL Score of 600 /Experian Score of 650 and above | |

| Rs 20,000 | Mumbai/Thane or the NCR region (Delhi, Noida, Gurgaon, Ghaziabad, Faridabad, etc.) | New to Credit or CIBIL Score of 600 /Experian Score of 650 and above | |

| Rs 15,000/td> | Metro City other than Mumbai and NCR | CIBIL Score of 600 /Experian Score of 650 and above | |

| Self-Employed Individuals | Rs. 15,000 | Any | CIBIL Score of 600 /Experian Score of 650 and above |

Factors That Affect Personal Loan Eligibility

Credit Score

Your credit score is a numerical measure of your credit worthiness. If you have a high credit score (>700) then you are considered to be less risky in terms of defaulting on your repayments and can therefore avail a higher amount of loan at lower interest rates.

Type of Employment

Lower the risk associated with repayment, lower is the interest rate imposed. This is why salaried applicants generally get loans at lower interest rates as this type of employment poses less risk compared to self-employment.

Income Level

Higher the income, higher is the repayment ability as long as there aren’t multiple loans active at the same time, i.e., as long as your debt-to-income ratio is low. At MoneyGray, we require applicants to have a minimum monthly in-hand income of Rs. 13,500 for those who are salaried and Rs. 15,000 or more for those who are self-employed.

Age

Another factor that determines eligibility is your age. Usually those currently in the earning bracket can avail loans easily while those closer to retirement will not be able to and even if they do, it will be at higher interest rates. At MoneyGray, you must be between 18 to 55 years old in order to avail personal loans.

Area of Residence

Those in Tier - I cities usually have a higher income and credit score requirement as compared to those living in Tier -II and Tier -III cities as the income as well as expenses may be higher making the repayment a little more riskier.

Tips For Salaried Person To Check Eligibility

Have a monthly income of Rs. 13,500 or more

Your income must be credited directly to your bank account

If these criteria are fulfilled, here is a tip for you to check your eligibility and ensure easy loan repayments.

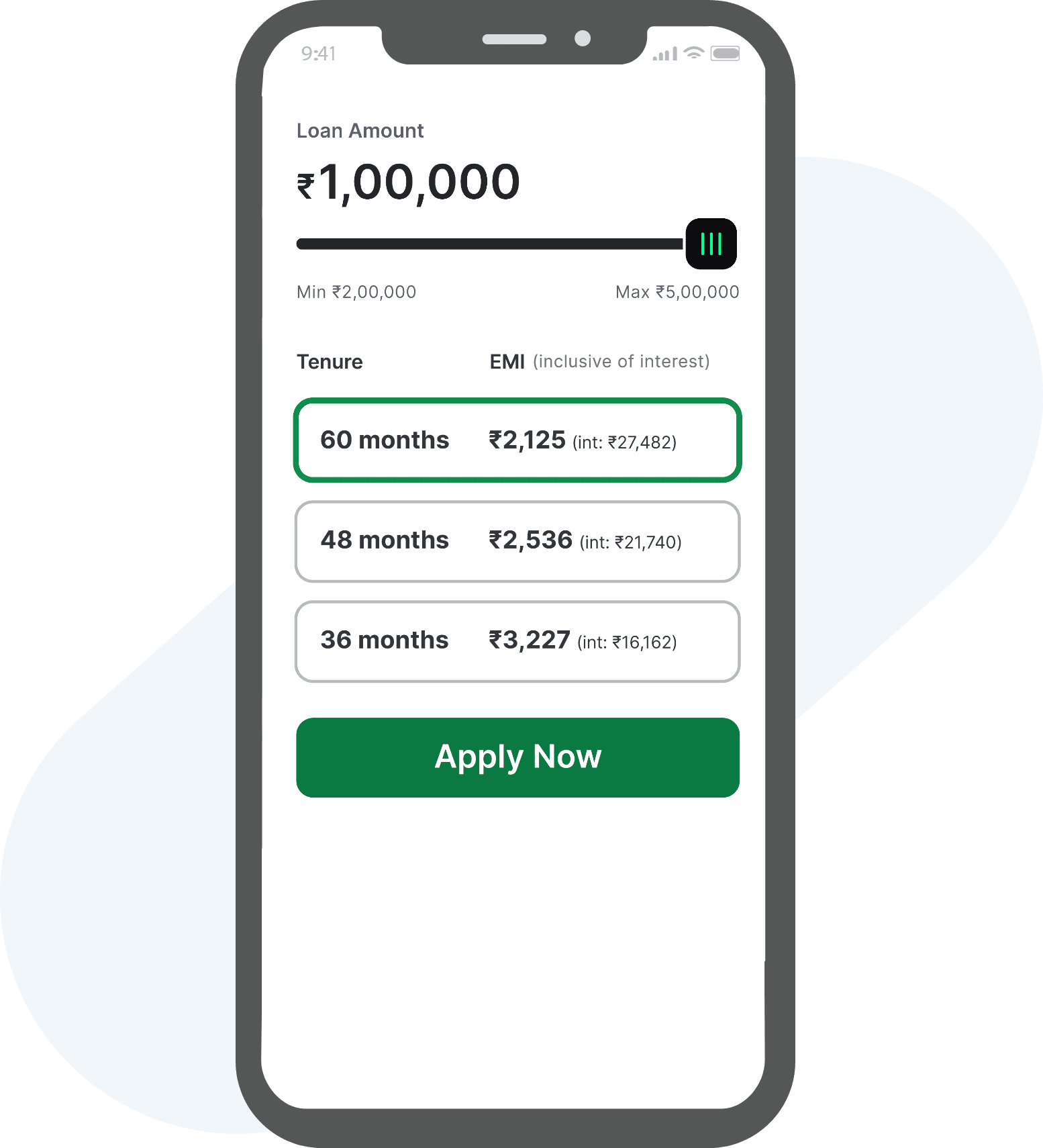

In addition to your income, the amount you avail as a loan, interest imposed, and the repayment term can help you plan your repayment schedule.

The MoneyGray Personal Loan EMI Calculator can help you find out exactly how much you owe and knowing this will help you plan out your expenses if you are eligible for the loan amount of your choice.

Tips For Self-Employed Person To Check Eligibility

Have a monthly income of Rs. 15,000 or more

Your income must be credited directly to your bank account

If these criteria are fulfilled, here is a tip for you to get the best out of your personal loan.

If you know the loan amount that you wish to get, the repayment term, and interest rate, you can easily find out your EMI using the MoneyGray

Personal Loan Calculator. Doing so can help you plan out your budget as well as ensure that you are able to repay the loan on time.

How to Apply for An Instant Personal Loan

Check Eligibility

Provide a few basic details to check your eligibility in just 2 mins!

Select Loan Tenure

Choose a custom loan amount and the repayment period that suits your financial needs

Upload Documents

Provide your personal details and upload the necessary documents, all on the app or website

Amount Disbursed

Get the loan amount disbursed to your account in 2 hours of approval

Conclusion

Your personal loan eligibility is calculated based on various factors such as your income, credit score, age, etc. When all the conditions are optimally satisfied, you will be able to avail a loan easily and at competitive interest rates. What’s more?

At MoneyGray, we use a unique credit rating model which means that even if your credit score is on the lower side, you can get a personal loan easily.

To get an instant loan within 24 hours, visit the MoneyGray website and download the app and apply today!

Personal Loan Interest Rates - Related FAQs

1. What Are The Qualifications For Personal Loan Eligibility?

Ans: In order to be eligible to get a personal loan from MoneyGray, you must meet the following criteria -

- You must be salaried or self-employed

- You must be salaried or self-employed

- You must be salaried or self-employed

- You must be salaried or self-employed

If you fulfill the above personal loan eligibility criteria, you can apply for a loan from MoneyGray and finish our eligibility check which only takes two minutes. Based on this, we will create a custom loan offer tailored to meet your needs and requirements.

2. Can I Get A Personal Loan For A Low Salary?

Ans: Yes, you can. You can get an instant personal loan as long as your salary is Rs. 13,500 per month if you are salaried and Rs. 15,000 per month if you are self-employed. However, to be eligible, your salary must be credited to a bank account directly.

3. How Can You Check Your Personal Loan Eligibility At MoneyGray?

Ans: MoneyGray personal loan eligibility check takes just 2 minutes to complete. You can check your personal loan eligibility by either visiting the Money Gray website or by downloading our app.

4. Can I Get A Personal Loan If My Salary Is Less Than Rs. 20,000?

Ans: Yes, you can. At MoneyGray, we believe that access to financial services is a basic right for all. If you are a salaried employee and you earn Rs. 13,500 per month or if you are self-employed and you earn Rs. 15,000 per month, you can still apply for a personal loan from MoneyGray.

5. What Is The Maximum Loan Amount You Can Avail From MoneyGray?

Ans: The maximum amount you can borrow from MoneyGray is Rs. 25 lakhs. However, we provide a custom offer for each applicant based on their eligibility criteria therefore this amount may vary.

6. What Is The Minimum Salary To Get A Personal Loan?

Ans: In order to get a personal loan from MoneyGray, you need to fulfill the following criteria -

- If you are a salaried employee, you will need to earn a minimum of Rs. 13,500 per month

- If you are self-employed, you will need to earn a minimum of Rs. 15,000 per month

Your salary must be credited to your bank account directly.

7. How Is Personal Loan Eligibility Calculated Based On Salary?

Ans: Your salary is one of the most important eligibility criteria that lenders consider while disbursing loans. At MoneyGray, you need to have the following minimum salary to be eligible for our personal loan -

- If you are a salaried employee, you will need to have a minimum monthly income of Rs. 13,500

- If you are self-employed, you will need to earn a minimum monthly income of Rs. 15,000

Your salary must be credited to your bank account directly.

8. Will I Have To Pay A Fee To Check My Loan Eligibility?

Ans: No, you do not have to. The entire loan application process is completely free of cost. All you have to do is fulfill the following eligibility criteria before applying for our personal loan -

- You must be Salaried or Self Employed (own business)

- Your monthly in-hand income should be Rs 13,500/- or more. To know more, click here

- Your salary must be directly credited to your bank account

- You must either have a minimum CIBIL score of 600 or a minimum Experian score of 650. Low Credit Score? You may still get a loan based on our own credit-assessment model.

- Applicants must be between the ages of 18 years to 55 years

If you do fulfill the above criteria, then visit the MoneyGray website and download the app and apply. We will take care of the rest!

9. How Does My Income Affect My Personal Loan Eligibility?

Ans: Your income is one of the most important factors that determine your personal loan eligibility. Higher the income, greater is your ability to repay the loan. However, if you have multiple loans running at the same time then your repayment ability will be affected.

This is why before you get a loan, it is important to ensure that you are in a comfortable position to repay.

At MoneyGray, we require applicants to have a minimum monthly income of Rs. 13,500 that is credited directly to their bank account.

10. How Does My Current Debt Status Affect My Eligibility?

Ans: When you apply for a loan, your lender will consider your existing debts. If you have a high debt-to-income ratio, i.e. you are repaying multiple loans through your existing income, then your perceived creditworthiness will be low. It indicates that you may not be able to repay a new loan easily if you are already repaying multiple loans and this will impact your eligibility criteria and your ability to avail loans easily.

Therefore, always try to keep your debt-to-income ratio low.

11. Will I Be Eligible For A Personal Loan Even If I Have Bad Credit?

Ans: At MoneyGray, we use a unique credit rating model that considers criteria including but not limited to your credit score. Therefore, even if your credit score is on the lower side, you can still get a personal loan from MoneyGray.

The minimum credit score requirement is a CIBIL score of 600 and above or an Experian score of 650 and above.

12. What Is The Age Limit To Avail A Personal Loan From MoneyGray?

Ans: You need to be between 18 years to 55 years in order to get a personal loan from MoneyGray.

13. What Should Be The Minimum CIBIL Score For Availing A Loan From MoneyGray?

Ans: Since we use our own credit rating model at MoneyGray, you need to have a minimum CIBIL score of 600 or a minimum Experian score of 650 to get a personal loan from us.

*Starting interest rate varies on factors like credit history, obligation, or lender. #Indicative disbursement time measured for a loan of Rs 50,000 carried under controlled conditions. Subject to the necessary KYC and Income Verification. T&C apply.

Copyright © 2023 MoneyGray. All rights reserved. (Page rendered in 0.0468 seconds)

Built with Love

Made in India